India’s Defence Budget (2010-2011): Wake up call for Defence Managers

As per the Budget Estimates (BE) proposed for the year 2010-11, the total expenditure of Central government will be Rs. 11,08,749 crore, which is an increase of 8.6 per cent over total expenditure in BE of 2009-10. The Plan and Non Plan expenditure in BE 2010-11 are estimated at Rs. 3,73,092 crore and Rs. 7, 35,651 crore, respectively. While there is a 15 per cent increase in Plan expenditure, the increase in Non Plan expenditure is only 6 per cent over BE of 2009-10. The fiscal deficit has been projected as 5.5 percent of GDP in 2010-11 against 6.9 per cent during the preceding year.

The fiscal year 2009-10 was a challenging year for the Indian economy. The significant deceleration in the second half of 2008-09 brought the real GDP growth down to 6.7 per cent, from an average of over 9 per cent in the preceding three years. However, due to implementation of broad based counter cyclic policy package, the negative fallout of the global slowdown has been arrested. Although due to fiscal expansion and liberal monetary policy, the Indian economy is showing some signs of stabilization, unless there is consolidation of gains achieved during the last fiscal year the economy may take longer to revert to the high GDP growth path.

The Thirteenth Finance Commission has recommended a calibrated exit strategy from the expansionary fiscal stance of the last two years. As a part of the fiscal consolidation process, the Finance Minister in his Budget speech on February 26, 2010 proposed to reduce the domestic public debt-GDP Ratio. In the Medium Term Fiscal Policy Statement, the Government has proposed a rolling target for fiscal deficit in the next two fiscal years. It is proposed to bring down the fiscal deficit from 5.5 per cent of GDP in 2010-11 to 4.8 per cent in 2011-12 and to 4.1 per cent in 2012-13.

The expenditure on Defence comes under Non Plan expenditure. As per the Budget Estimates for the year 2010-11, Defence has been allocated Rs. 1,47,344 crore, i.e. a marginal increase of 3.98 percent over the BE of 2009-10. The outlay for Defence comprises of Rs. 87,344 for Revenue expenditure1 and Rs. 60,000 crore for Capital expenditure2. Keeping in view the requirement of Defence for modernization of forces, the Capital budget has been given an increase of 9.44 per cent over the BE of 2008-09. The revenue allocation has increased only by 0.5 percent. However, there is a net reduction in allocation of Rs. 1096 crore in Revenue budget in comparison to the Revised Estimates of 2009-10. Last year, the Revenue budget was increased by 50.85 per cent over the BE of 2008-09 due to implementation of the Sixth Pay Commission’s recommendation. Since part of that was a one time expenditure, thus no additional funds were required under the Pay and Allowances head this year. However, considering the fact that a substantial part of Revenue expenditure is incurred on Stores & Equipment, Transportation, Revenue Works, Maintenance of Buildings, Installation, etc. and there is a danger of double digit inflation, thus the proposed allocation under these heads of expenditure will require extra effort on the part of defence functionaries to prioritise expenditure without compromising the operational readiness of the forces.

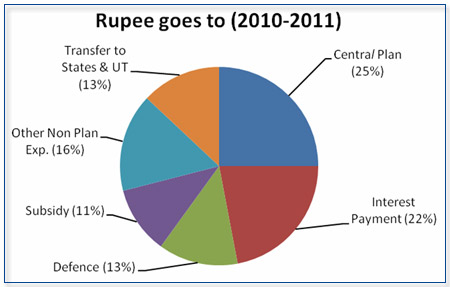

A look at the chart below shows that about half the expenditure is such that the Central Government has little control over it. The only expenditure which can be controlled by the Central Government is Central Plan (25 per cent), Defence (13 per cent) and other Non Plan expenditure including Pensions (16 per cent).

Due to rising social and political tensions in different parts of the country, there is far greater need for inclusive growth. To achieve this goal the government has to allocate more resources for infrastructure development, health and education, etc. Thus Plan expenditure is bound to rise in the coming years and consequently the Government will have to take steps to reduce Non Plan expenditure to achieve reduction in the fiscal deficit as mentioned above. Considering the security environment in and around India, the government will have to provide more funds under the Capital budget required for modernization of forces. Thus, Defence authorities will have to work out how to function with a minimal increase in the Revenue budget.

The Thirteenth Finance Commission has observed that there exists considerable scope to improve the quality and efficiency of defence expenditure through increased private sector engagement, import substitution and indigenization, improvements in procedures and practices and better project management, within the parameters of Government of India’s policy. Efforts in this direction will further expand the fiscal space available for defence spending.

The Standing Committee on Defence in its report on Demand for Grants (2009-10), placed in the Lok Sabha on December 16, 2009, also recommended that there is an urgent need to curb wasteful expenditure. The Committee has consistently been raising this issue in its earlier reports as well. In pursuance thereof, the Ministry had constituted a Defence Expenditure Review Committee (DERC) to comprehensively review all aspects of defence expenditure. The committee has already submitted its report. However, the action taken report on DERC recommendations indicating the areas where expenditure can be curbed is awaited. Since tax payer’s money is spent on such committees it is essential that the outcomes of their recommendations be placed in the public domain.

The Ministry of Finance had projected a growth rate of 7 per cent per annum for defence revenue expenditure. Capital expenditure is projected to grow at 10 per cent per annum. The resultant projection for overall annual growth rate of defence expenditure works out to 8.33 per cent.3 However, due to the economic slowdown and the compulsion of providing more funds for inclusive growth, the allocation for Defence is less (particularly for revenue expenditure) than what was projected by the Ministry of Finance. This situation is likely to continue into the near future. Thus, Defence Mangers need to initiate immediate measures to control the rising revenue expenditure.

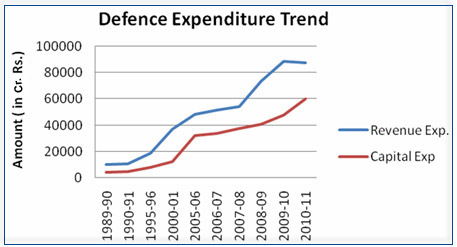

The Revenue expenditure of Defence has grown from Rs. 10,194 cores in 1989-90 to Rs. 87,344 crore in 2010-11, i.e. an increase of almost nine times during the last two decades. A look at the graph below shows that Revenue expenditure is growing at a much faster pace in comparison to Capital expenditure.

Note: Based on RE figures for 2009-10 and BE figures for 2010-11 budget. For remaining years actual expenditure has been taken.

The revenue expenditure trend for the last three years shows that about 46 per cent of expenditure is incurred on pay and allowances, 35 percent on stores and equipment, 10 per cent on revenue works, 4 per cent on transportation, and 5 per cent on Miscellaneous Charges. To check the rising revenue expenditure, the following measures could be considered:

- Since more than half of revenue expenditure is spent on pay and allowances, to reduce expenditure on this account in the short term is not possible. However, considering the fact that the nature of war has changed, there is a need to develop force structures that are capability based and not threat based. Defence transformation through technological improvements is the need of the hour. Further, the three Services need to be integrated through reorganisation of higher formations and through joint training and joint procedures, which will ensure coherence and synergy. All this will facilitate the downsizing of the armed forces and result in a reduction in revenue expenditure.

- A substantial portion of expenditure is incurred on stores and equipment. It also comprises of expenditure on maintenance of equipments. It is a well established fact that the cost of arms acquisition is only a small fraction of the life cycle cost and logistics and maintenance management is a far more important activity. Consequently, countries like the United States and United Kingdom have adopted a performance based logistics (PBL) strategy for system support as a result of which the availability and reliability of systems have improved. Under this strategy, the original manufacturer or its nominated contractor maintains the weapon system at the specified level of operational readiness and usage, and is paid a graded incentive for exceeding the specified levels of system maintenance. The PBL has been found to be a far more cost effective solution than in-house logistics and maintenance management. The requirement of existing service logistics and maintenance infrastructure could be reduced by adopting this strategy. Further, modern supply chain management techniques need to be employed to reduce storage echelons and inventory holding, by making more use of ICT.

- The process of implementation of outcome budgeting in Defence needs to be expedited. It will bring accountability into the system and authorities will be required to define and identify the objects for which funds are required and then intimate what outcome(s) have been achieved. It will reduce ad-hoc decision making and thus reduce wasteful expenditure. Some of the service-specific organizations and establishments, such as workshops, repair organizations, naval dockyards and depots, should immediately be brought under the regimen of outcome budgeting.

- In the case of transportation, expenditure could be reduced by making more use of railways facilities instead of road transport. There are some co-ordination problems with the Railways which need to sorted out since it is in the interest of both the departments. Now large numbers of Defence Personnel are entitled to fly by air. There is a tendency to go for full fare ticket (even in normal circumstances) when cheap air tickets are also available. The total expenditure on this account may be negligible but the issue is not that of amount. In fact, it reflects the fact that while spending Government money the canons of financial propriety are not being adhered to in letter and spirit.

- The revenue expenditure is regulated by the principles and procedures contained in the Defence Procurement Manual (DPM)-2009. With a view to improving the quality of expenditure, the Ministry of Defence has delegated substantial powers to Services Headquarters and lower formations. This delegation has certainly helped in improving the speed of the expenditure but the same cannot be said about the quality of expenditure. There are instances of procurement of items without adequate justification and in excess quantity. To reduce wasteful expenditure the system of allocation of some grants every year without ascertaining the actual requirement needs to be reviewed. For example, every year funds under Hot Weather Grants are allotted which is not required since many units do not need Matkas (earthen wares) as they have made provision for water coolers.

- Moreover, the units get a number of grants and in many cases the amount is a few thousand Rupees only. These grants are received by units through different directorates of Service Headquarters. Since processing and intimation of these grants involves a lot of manpower, it needs to be considered whether units should be given a lump sum amount for Miscellaneous expenditure and be authorised to use the same as they deem fit for the defined purpose. It will improve quality of fund utilisation and reduce manpower requirement of Headquarters, thereby resulting in savings in expenditure.

- While delegating financial power to lower formations it was assumed that Local Purchases would be more economical. However, it is difficult to say that the desired purpose has been achieved. To bring economy in local purchases it is essential that Central Authorities ensure that as far as possible Rate Contracts for the items required by field units are concluded.

- Presently Units/Formations prepare procurement plan (except for ACSFP & TAG Grant) after funds are received. Presently, the endeavour is to ensure that all allotted funds are utilised and in the process many items are procured which are not required or purchased in excess of requirement. To overcome this situation it should be made mandatory for units/formations to prepare Priority Procurement Plan for all types of purchases in advance and no new items shall be included unless unavoidable. The present system compels officers to spend the allotment even though it may not be essential or urgent.

- Defence should adopt Project Management approach for inducting complete systems or setting up facilities to enhance operational readiness on a life cycle basis. By adopting new methodologies along with Information Technology, optimal control of the projects at each phase of the project life cycle is feasible. Effective Project Management will facilitate achievement of desired outcome and time and cost over-runs could be minimised, resulting in substantial savings in expenditure.

- 1. Expenditure on items costing up to Rs 10 lacs with life less than 7 years is categorized as Revenue Expenditure.

- 2. Expenditure incurred on individual item costing more than Rs 10 lacs having life more than 7 years, to create a permanent asset is categorized as capital expenditure.

- 3. Report of the 13th Finance Commission (2010-2015), pp. 83