Background Paper

Definition, Forms and Types of Offsets Offsets

are ‘compensations’ demanded by buyers from sellers in return for outflow of resources to the latter. These are applied for the so-called off-the-shelf procurement of items. Offsets come in different forms, but they are broadly divided into two types of categories – direct offsets and indirect offsets. Direct offsets are those transactions that are directly related to the defence items or services exported by a defence firm. Indirect offsets are those transactions that are not directly related to the defence items or services exported by the supplying firm. Indirect offsets are further divided into:

- Defence related indirect offsets

- Non-defence related indirect offset

Depending upon the forms, offsets can be divided into the following categories:

Offsets: Global Practice and Trend

The use of offsets in international trade is widespread and more than 130 countries practice it in different forms2. It is believed that offsets and related forms of countertrade account for about 5 to 30 per cent of world trade3. In defence, offsets are often used by buyer countries as “discriminating factor” in their arms contracts. The volume of offset and its greater percentage applicability in arms contracts is quite huge. Though the exact value of global defence offsets is not readily available, some idea can be formed from the data provided by the US Department of Commerce’s Bureau of Industry and Statistics (BIS) which tracks the offset obligations of the US defence contractors who are also the top arms exporters in the world. As per the 2007 BIS Report, during the 14 year period from 1993 to 2006, the US defence companies signed 582 offset agreements with 42 countries, with total value (of all offset agreements) amounting more than $60 billion, or over 71 per cent of agreed export value4. In 2006 alone, it signed 44 offset agreements worth nearly $3.5 billion with 12 companies from 20 countries5. In terms of actual transactions, the US companies reported nearly $42 billion of actual offset transaction with 42 countries during the above time period6.

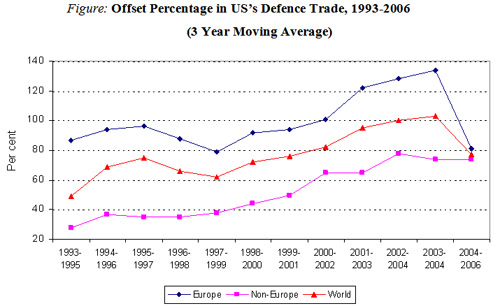

With time, the percentage demand for offsets – though still varies from region to region and country to country – has increased significantly. It is because countries that did not “require offset during pre-1990s are now require them as routine policy” and, some countries have increased their demands over a period of time. In the above mentioned 14-year period, the US, has witnessed offset percentage of its defence trade increasing, on an average, from 34.3 per cent in 1993 to nearly 125 per cent in 20037, before decreasing to some 71 per cent in 2006. Region-wise, European countries with an average offset demand of 98.4 per cent during the above period are ahead of North and South America (97 per cent), Middle East and Africa (44 per cent), and Asia Pacific (39.1 per cent)8. A 3 year moving average of offsets demanded (in percentage terms) from the US defence contractors is shown in the Figure below.

Note: Extrapolated from Table 4-2: Offset Agreement: Europe Compared to the Rest of World 1993-2006

Source: BIS Offsets database, as cited in U.S. Department of Commerce, Bureau of Industry and Security, Offsets in Defence Trade: Twelfth Report to Congress, December 2007, pp. 4-7.

A closer look at the offset strategies of various countries throws the following aspects (see Table below for a list of offset strategies of 15 countries). The minimum threshold of offset value of defence contract is as low as US $0.5 million (Israel), and is well below US $20 million for the select countries. The minimum offset required as a percentage of contractual value is nearly 100 per cent for these counties with few exceptions such as Israel (35 per cent) and Taiwan (70 per cent) that demand less. Moreover, more than half of the select counties prefer both defence and non-defence offsets. In Europe, the relatively advanced industrialised counties such as the UK and Italy prefer only defence-related offsets9 and the region, on an average, prefer nearly 75 per cent defence related offset and the rest are civil indirect offset10.

Table: Offset Statistics of Select Countries

| S.No | Country | Minimum Value of Defence Contract | Minimum Offset Required | Offset Sector | Multiplier |

|---|---|---|---|---|---|

| 1 | Australia | US $3.75 million |

No Specific Min. of Max |

Defence |

None in policy |

| 2 | Canada |

100% |

Defence & Civilian |

None in policy |

|

| 3 | Finland |

100% |

Defence |

0.3-3 for exports of finish products; for others multiplies are negotiated |

|

| 4 | Greece |

10 € million |

120% |

Defence |

Up to 10 |

| 5 | Israel |

US $0.5 million |

35% |

Defence & Civilian |

1-1.5 |

| 6 | Italy |

US $6.6 million |

Not less than 70% |

Defence |

Maximum of 3 |

| 7 | Netherlands |

5 € million |

100% |

Defence & Civilian |

Negotiable; ranges of 1-5, 5-10, and 10-30 |

| 8 | Norway |

US $6.7 million |

100% |

Defence & Civilian |

0-5 |

| 9 | Poland |

5 € million |

100% (defence 50% min) |

Defence & Civilian |

Negotiable up to 2-5% |

| 10 | South Korea |

US $10 million |

30% |

Defence |

Determined by authorities |

| 11 | Spain |

NA |

100%, but may vary |

Defence & Civilian |

Between 2 and 5, when used |

| 12 | Switzerland |

US $17 million (may vary) |

100% |

Defence & Civilian |

Maximum of 2-3 |

| 13 | Taiwan |

US $10 million |

Will be increasing to 70% |

Defence |

1-10 |

| 14 | Turkey |

US $10 million |

50% |

Defence & Civilian |

1-5 |

| 15 | UK |

US $17.2 million; ? 50 million for French & German Companies |

100% target |

Defence |

No multiplier for IP credit |

Source: U.S. Department of Commerce, Bureau of Industry and Security, “Offsets in Defense Trade: Twelfth Report to Congress”, December 2007.

Multipliers

Multiplier is a “factor applied to the actual value of certain offset transactions to calculate the credit value earned.” For example, if multiplier of, say, 2 is applied to an offset transaction of $10 million, then the credit value of such transaction amounts to $20 million.

Countries often provide multipliers towards the fulfilment of offset obligation by the foreign companies. Foreign companies see multipliers as inducements as it raises the credit value of offsets, and thus reduces the “dollar value” of their obligations. The buyer countries, on the other hand, use this as a tool to engage the overseas companies in a certain type of activities that they view important for their industrial or overall economic development. For instance, Denmark offers multiplier of maximum of 10 but restricts it to few cases such as R&D, Technology transfer, among others11. Globally the range of multipliers varies widely, from low of 0.3 to high of 30 (see Table). However, according to the BIS database, over the years the percentage use of multipliers in offset transaction is following a continuous declining trend, coming down from 16.6 per cent in 1993 to 4.3 per cent in 2006.

India’s Defence Offset Policy

India’s formal offset policy came for the first time under Defence Procurement Procedure 2005 (DPP 2005). The policy of 2005 was further elaborated in DPP 2006 and subsequently revised under DPP 2008 . The offset policy as enunciated in DPP 200812 stipulates that all contracts worth three billion rupees or above would have defence-specific offsets amounting to 30 per cent. The offset obligations of the foreign vendors shall be discharged thorough any combinations of the following methods:

- Direct purchase of, executing export orders for, defence goods and services produced by any Indian defence industry.

- Direct foreign investment in Indian defence industrial infrastructure, leading to co-development and co-production of defence items.

- Direct foreign investment in Indian organisations engaged in research in defence R&D as certified by DOFA.

Multipliers

At presents, India’s offset policy does not have the provision of multiplies. The policy categorically says that all offset offers satisfying the minimum eligibility conditions will be treated on par and no extra preference will be given beyond the minimum requirements.

Banking of Offset Credits

India’s offset policy provides provision of banking of offset credit with effect form September 1, 2008. The provision allows two ways through which a foreign vendor can bank credits: one, through prior investment in the Indian defence industry (including in Defence R&D); and, two, by generating excess credits from the ongoing offset projects. In other words, the banking provision allows foreign vendors’ prior as well as continuous opportunities in Indian defence industry, to discharge their future offset obligations. The banking period is allowed to remain valid for two financial years from the date of approval by the MoD. The banked offset credits are non-transferable except between the main contractor and his sub-contractor within the same acquisition programme.

Product List and Industrial Licensing Under the offset provisions, foreign vendors are allowed to choose any Indian companies as their offset partner. To facilitate Indian companies’ participation in offset-related work, the MoD has provided a list of defence products. The list is categorised along the following 13 groups:

- Small arms, mortars, cannons, guns, howitzers, anti tank weapons and their ammunition including fuze.

- Bombs, torpedoes, rockets, missiles, other explosive devices and charges, related equipment and accessories specially designed for military use, equipment specially designed for handling, control, operation, jamming and detection.

- Energetic materials, explosives, propellants and pyrotechnics.

- Tracked and wheeled armoured vehicles, vehicles with ballistic protection designed for military applications, armoured or protective equipment.

- Vessels of war, special naval system, equipment and accessories.

- Aircraft, unmanned airborne vehicles, aero engines and aircraft equipment, related equipment specially designed or modified for military use, parachutes and related equipment.

- Electronics and communication equipment specially designed for military use such as electronic counter measure and counter measure equipment surveillance and monitoring, data processing and signaling, guidance and navigation equipment, imaging equipment and night vision devices, sensors.

- Specialized equipment for military training or for simulating military scenarios, specially designed simulators for use of armaments and trainers.

- Forgings, castings and other unfinished products which are specially designed for products for military applications and troop comfort equipment.

- Miscellaneous equipment and materials designed for military applications, specially designed environmental test facilities and equipment for the certification, qualification, testing or production of the above products.

- Software specially designed or modified for the development, production or use of above items. This includes software specially designed for modeling, simulation or evaluation of military weapon systems, modeling or simulating military operation scenarios and Command, Communications, Control, Computer and Intelligence (C4I) applications.

- High velocity kinetic energy weapon systems and related equipment.

- Direct energy weapon systems, related or counter-measure equipment, super conductive equipment and specially designed components and accessories13.”

An Indian company producing any of the above products is eligible to become offset partner of a foreign vendor. However, the Indian “offset partner shall, besides any other extant regulations in force, also comply with the guidelines / licensing requirements for the defence industry issued by the Department of Industrial Policy and Promotions.

Defence Offset Facilitation Agency (DOFA)

Consequent to the announcement of India’s offset policy, a dedicated body, Defence Offset Facilitations Agency (DOFA), has been set up under the Department of Defence Production, Ministry of Defence. DOFA, as the name suggests, is a facilitation agency, tasked to perform the following functions14:

- Facilitate implementation of the offset policy.

- Assist potential vendors in interfacing with the Indian defence industry.

- Assist in vetting offset proposals technically.

- Assist in monitoring the offset provisions.

- Suggest improvements in the policy and procedures.

- Interact with Headquarters Integrated Defence Staff and Service Headquarters.

- Advise, in consultations with the Headquarters Integrated Defence Staff, Services and Defence Research and Development Organisation, areas in which offsets will be preferred.

- Promote exports of defence exports of defence products and services.

Notes

- 1. According to the US Department of Commerce, subcontracts are only direct offset. Others, however, differ from this usage, arguing that subcontracts could also be indirect offsets if they are not directly related to the procured items.

- 2. Elisabeth Sköns, The Economic Aspects of Defence Offsets: Experience from Sweden and Finland.

- 3. Jurgen Brauer and J. Paul Dunne, “Arms Trade and Economic Development: Theory, Policy and Cases in Arms Trade Offsets”, Routledge, New York, 2004, pp.2.

- 4. U.S. Department of Commerce, Bureau of Industry and Security, “Offsets in Defense Trade: Twelfth Report to Congress”, December 2007, pp. 2-1 to 2-14.

- 5. Ibid.

- 6. Ibid, pp. 2-3.

- 7. This is on account of “one large weapon system export… with an offset percentage of more than 170 per cent”

- 8. The figures represent average of 14-year period covering 1993 to 2006.

- 9. “Offsets in Defence Trade: Twelfth Report to Congress”, n.4.

- 10. E. Anders Eriksson et al, “Study on the effects of offsets on the Development of a European Defence Industry and Market”, available at http://www.eda.europa.eu/documents.aspx (accessed on July 10, 2008).

- 11. See Danish Enterprise and Construction Authority, Multipliers, at http://www.deaca.dk/multipliers

- 12. See Government of India, Ministry of Defence, Defence Procurement Procedure: Capital Procurement 2008, at http://mod.nic.in/

- 13. Ibid, pp. 54.

- 14. Ibid, pp.44.

| Attachment |

|---|

Download Complete [PDF] Download Complete [PDF] |